As a formerly licensed car dealer, I’ve had many customers over the years who filed Chapter 13 bankruptcy and needed to replace vehicles that died or were damaged beyond repair.

Navigating how and when you can purchase a car in active bankruptcy can be extremely confusing.

Relevant Articles To Read Related To Bankruptcy and Car Shopping: How soon after bankruptcy can I buy a new car?

Based on extensive research to find answers, here is what you need to know:

Table of Contents

Getting Trustee Approval is Essential

The first critical thing I advise all Chapter 13 bankruptcy customers is that you absolutely must get written permission from your trustee before financing or purchasing a replacement vehicle.

This rule applies even if you plan to buy from smaller “buy here pay here” dealerships that don’t run credit checks.

Violating this requirement can trigger penalties such as case dismissal, surrendering the car, damaged credit, or court sanctions.

I’ve seen customers lose vehicles purchased without proper approvals. It can undermine the entire bankruptcy process. So consult your bankruptcy attorney before making any moves.

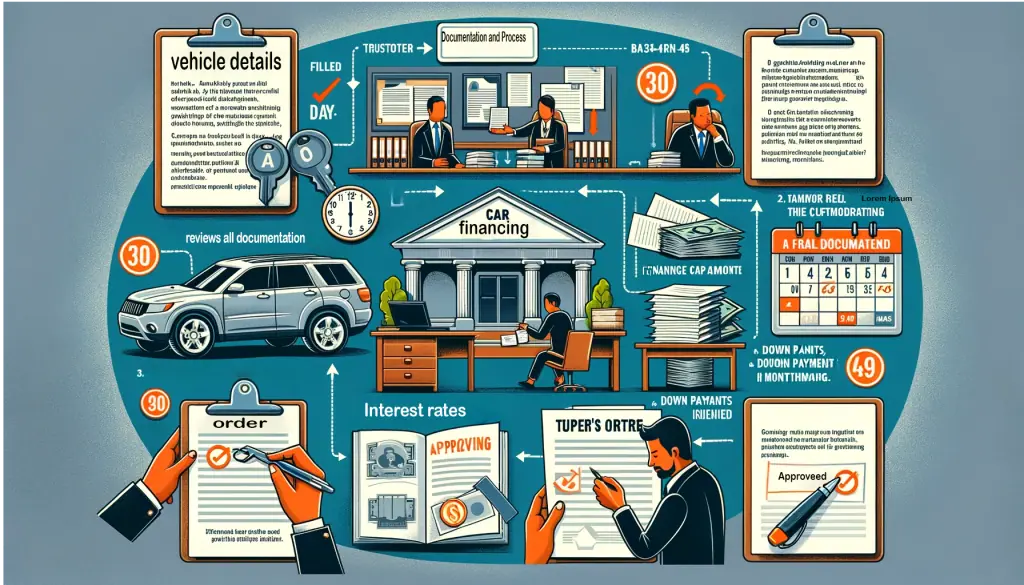

Documentation and Process Required

Gaining trustee permission involves filing detailed paperwork on the proposed purchase, including financing terms, vehicle details, costs, reasons for needing it, and confirmation it won’t impact existing bankruptcy payment plans.

Expect the approval process to take 30-45 days after your bankruptcy attorney submits the full motion to incur debt. Information required typically includes:

- Buyer’s order with vehicle specs

- Amount being financed

- Interest rates

- Down payments

- Monthly payment amounts

The trustee reviews all documentation, determines if the purchase fits budget limits, and makes an approval decision. If approved, the court issues a formal order permitting the car financing transaction under stated terms. Requests denied by the trustee can still be appealed via court hearing (3).

Few Lenders Will Issue Loans in Active Bankruptcy

Through research and previous customer experiences, I’ve learned that extremely few mainstream lenders are willing to finance vehicles for Chapter 13 customers prior to discharge.

The 30-45 day trustee approval process is far too long for most banks and credit unions. However, some subprime lenders are more amenable provided you meet their terms.

Smaller “buy here pay here” lots eager to make quick sales may also work with active bankruptcy customers.

But they often impose predatory loan rates and structures prohibited under Chapter 13 rules. If discovered later, these loans can be cancelled and vehicles recalled per trustee discretion.

Alternatives If Trustee Approval is Denied

If your initial request to purchase a replacement vehicle is rejected by the bankruptcy trustee or courts, there are still some options to explore:

- Expedited Motions – If vehicle is essential for work transportation or other urgent needs, have your attorney request faster processing.

- Voluntary Case Dismissal – As a drastic last resort, you can request full dismissal of your bankruptcy case to buy an essential car if no other options exist (risky move eliminating all bankruptcy protections) (5).

- Cash Purchase – Buying a replacement vehicle with cash savings does NOT require trustee approval, provided it doesn’t violate “disposable income” clauses.

- Public Transportation – Where available, buses, trains, ride shares can provide temporary transportation until Chapter 13 completion.

My Closing Thoughts

While frustrating if trustee approval is denied or delayed, following proper legal procedures is critical for Chapter 13 bankruptcy completion. Consult experienced bankruptcy counsel for personalized advice navigating this complex process.

They can assess your odds of approval in your jurisdiction and with your unique financial situation.