Wondering what’s involved with legally signing over ownership of your vehicle to a family member?

As a former licensed car dealer, I’ve helped countless customers transfer titles between spouses, parents, children, and other relatives, and that’s what I’m going to help you do today.Step Responsibility Actions 1. Ensure Clear Title Current owner – Confirm the title is free of any liens or loans- Obtain lien release from lender if necessary 2. Complete Transfer of Ownership Section Current owner – Locate “Transfer of Ownership” section on title certificate- Sign over the title as the current owner/seller- Print names of current owner and family member receiving the car- Check state requirements for notarization of signatures 3. Provide Odometer Reading Current owner – Record current odometer reading in the designated space on the title 4. Complete Bill of Sale Current owner and receiving family member – Fill out a bill of sale, even if no money is exchanging hands- List the sale price as $0 if it’s a gift 5. Provide Proof of Insurance Receiving family member – Obtain proof of insurance coverage for the vehicle, if required by state 6. Visit DMV Office Current owner and receiving family member – Bring signed title, bill of sale, proof of insurance (if required), and payment for title transfer fee- Fee amount varies by state 7. Undergo Emissions Testing Receiving family member – Complete emissions testing before registration, if required by state– Requirements vary; some states only require for newer vehicles 8. Obtain New Title DMV – DMV issues a new title certificate in the family member’s name once all documents and fees are provided 9. Pay Sales Tax Receiving family member – Pay sales tax on the vehicle’s value, if required by state- Some states exempt this for certain family relations like spouses or children

Note: Key things to be aware of are notary requirements for signatures, emissions testing rules, and potential sales tax exemptions, as these can differ across states for transferring to a family member. Following the DMV’s specific instructions for your state is recommended.

Table of Contents

Relevant Articles You Might Want To Read:

- How Much Is Gift Tax On a Car

- How To Sign Over A Car Title

- Two Names On Car Title How To Remove One

- How to Transfer a Car Title After Death of Owner

How Car Title Transfers Work

A car title legally proves ownership. Transferring it to a family member involves:

- Current owner – Signs title to release ownership

- New owner – Completes & signs their ownership details

- State DMV – Updates records to new owner

Standard fees apply, but some states waive taxes for family transfers.

While largely similar, keep reading to learn how transfers to relatives can differ from selling to non-family.

Transferring Title to Family vs Non-Family

Compared to standard transfers, rules for family members can vary regarding:

- Taxes – Some states exempt family from sales taxes

- Inspections – Smog/safety certifications may not be required

- Fees – A few states reduce transfer fees for relatives

I’ll cover taxes more later on. First, let’s walk through the paperwork.

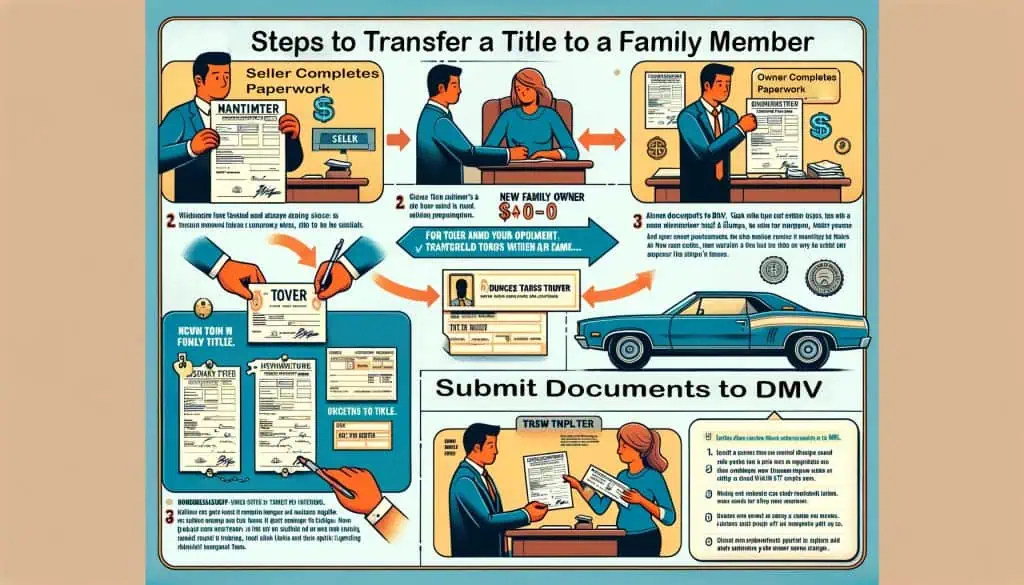

Steps to Transfer a Title to a Family Member

Follow these key steps to correctly change ownership with a relative:

1. Seller Completes Paperwork

As the current owner signing over the car, you must:

- Sign title transfer/seller section – All owners’ names if jointly owned

- List $0 for gift price if not selling for cash

- Provide vehicle miles and date

Notarization often isn’t mandatory for family but recommended.

2. New Family Owner Completes Paperwork

Next, the receiving family member must:

- Fill out transferee/buyer section on title

- Provide full name, address, etc as new owner

- Sign to accept ownership transfer

Double-check all vehicle details match title for accuracy.

3. Submit Documents to DMV

Finally, required paperwork must be filed with the state DMV, including:

- The signed title showing ownership transfer

- Any state-specific forms if applicable

- Transfer fees, typically $15-$25

Online title transfers are possible in some states for added convenience.

The DMV will then update its records and typically issue a new title to the family member within 30-60 days.

How to Transfer A Car Title to a Family Member In Another State

Actually, Transferring a title to a family member who lives in another state isn’t very different from the regular process of transferring a title within the same state,

except for the fact that the receiving family member’s state might have different registration requirements than the gifting member.

So, it is important not to take the advice of the gifting family member as to what needs to be done and to look specifically at the state’s requirements in which the car will be registered.

State-Specific Transfer Requirements

The vehicle title transfer steps can vary in certain states. Here are details on processes for some key areas:

Florida

To gift a car title in Florida: How to Transfer a Car Title to a Family Member in Florida

- Seller fills out “Transfer of Title By Seller” on title form

- Mark $0 for gift sale price

- Complete a Notice of Sale form

- Submit paperwork and fees to FL DHSMV

Ohio

When transferring ownership to family in Ohio:

- Seller signs title over to new owner

- Specify $0 gift sale price

- Have signature notarized

- Complete title transfer application

- Take documents to Ohio BMV

Virginia

For family transfers in Virginia:

- Seller fills out “Assignment of Title By Owner” section

- Mark $0 gift sale price

- Bring signed title, fees to VA DMV

- In-person transfer of ownership

Connecticut

To gift a car in Connecticut:

- Seller and recipient fill out AU-463 form

- Sign Motor Vehicle Gift Declaration

- Visit CT DMV together with documents

- In-person transfer required

As you can see, each state has minor differences in forms, fees, and other requirements when conducting a family title transfer. Check with your DMV for specifics.

Additional State By State Guides For Transferring Car Titles To Family Members:

- How To Transfer a Car Title in Illinois to a Family Member

- How to Transfer a Car Title to a Family Member in California

- How to Transfer a Car Title to a Family Member in NJ

- How to Transfer a Car Title to a Family Member in Texas

Transferring a Title to Family Online

While some states allow initiating title transfers online, fully digital processes for family members are currently unavailable. Physical documents and in-person DMV steps are still required.

A few states let you start applications online, but papers with wet signatures changing ownership must still be mailed or submitted to the local DMV branch.

No states yet enable completely virtual family gifting/sales without eventually presenting documentation in person.

Requirements still involve:

- In-person signatures transferring ownership (even if applying online first)

- Physically submitting title transfer documents

- Visiting DMV to formally register vehicle to new owner

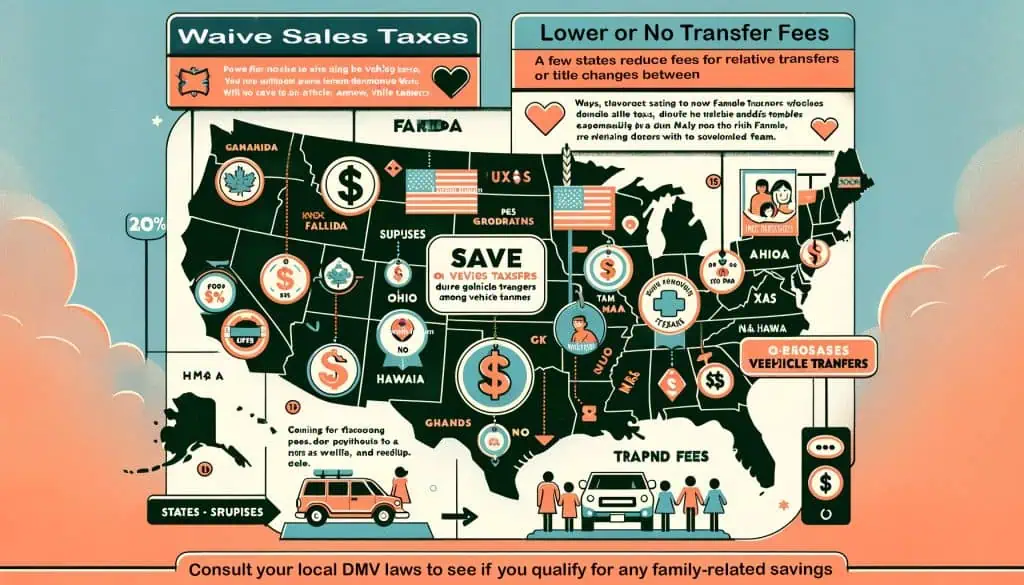

Saving on Fees and Taxes

Here are some ways you can potentially save money:

Waive Sales Taxes

Several states exempt sales tax between family members transferring vehicles. For example:

- Florida: No taxes on transfers between close relatives

- Ohio: No sales tax when gifting title to family

- Texas: Tax waived for cars gifted to siblings

Lower or No Transfer Fees

A few states reduce fees for relative transfers or title changes between:

- Spouses – e.g. $5 fee in Hawaii

- Parents & Children – Pennsylvania cuts this fee

- Grandparents & Grandkids – Free in Rhode Island

Consult your local DMV laws to see if you qualify for any family-related savings.

Tax Considerations When Gifting Cars

What gift tax rules exist around gifting car titles? Some key federal points:

- Tax only owed if over $17K annual exclusion (2023)

- Even then, tax not owed until $12.9M lifetime gifts reached

- Gifts over limit must still be reported on tax return

- Recipients don’t owe tax but take over registration/insurance/maintenance

Tips for Smoother Family Transfers

Follow these best practices when gifting or selling a car to a relative:

- Review ownership – No outstanding loans/liens

- Check DMV rules – Requirements for family transfers

- Get insurance info – From new owner to drive legally

- Save transfer evidence – Bill of sale, etc for records

- Follow up with registration – To complete ownership change

And if you run into any hiccups, don’t hesitate to contact the DMV directly or speak with an attorney.

Can Family Members Share Car Ownership?

Wondering if more than one family member can share ownership of a vehicle? The short answer is yes. Here are a couple options:

Joint Titles

You can change the title to include multiple family member’s names with wording like “AND” or “OR” between names. Both situations allow for shared ownership, but check details for your state.

Co-Signing

When financing a vehicle, a family member like a parent can co-sign the loan to add their name to the title until it’s fully paid off. Then ownership transfers solely to the original buyer.

Key Takeaways: Family Car Title Transfers

While car title rules differ slightly by state, following these core steps will ensure you correctly transfer ownership to a family member:

- Confirm no outstanding liens on title before transferring

- Properly sign over vehicle title to provide proof of gift/sale

- Have new owner complete & sign their ownership details

- Officially submit signed title and paperwork to DMV

- Verify new registration under family member’s name

And that covers the essentials for successfully changing vehicle ownership details within the family. Let me know if you have any other questions!

Sources For this Article:

- https://5starloans.com/transfer-car-title-to-family-member/

- https://www.rocketlawyer.com/family-and-personal/personal-property/buying-or-selling-a-vehicle/legal-guide/change-vehicle-ownership-transfer-a-title-with-the-dmv

- https://www.greenwichinfiniti.com/blogs/3512/how-to-transfer-vehicle-ownership-in-connecticut/

- https://www.octaxcol.com/how-to/florida-title-transfer/

- http://clerk.co.trumbull.oh.us/clerk_titleprobate.html

- https://blog.carvana.com/2022/12/buying-a-car-as-a-gift-read-this-gift-tax-co-signing-more/

- https://shipacardirect.com/the-comprehensive-guide-to-gifting-vehicles/